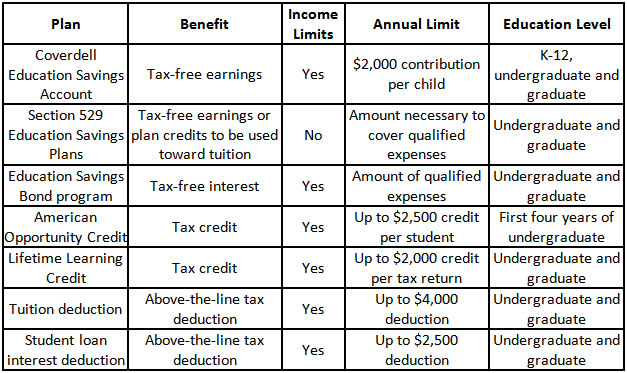

Need help decoding all the different education plans and tax benefits?

This quick reference chart is a good place to start.

Source: www.TaxAct.com 4-15-2014

Remember that not all college savings funds must be in designated education savings plans. Consider keeping some funds that may be used for college in other investments, such as real estate or a regular brokerage account, especially if your future income levels may disqualify you from certain tax benefits for tax savings plan distributions.

Recent Comments